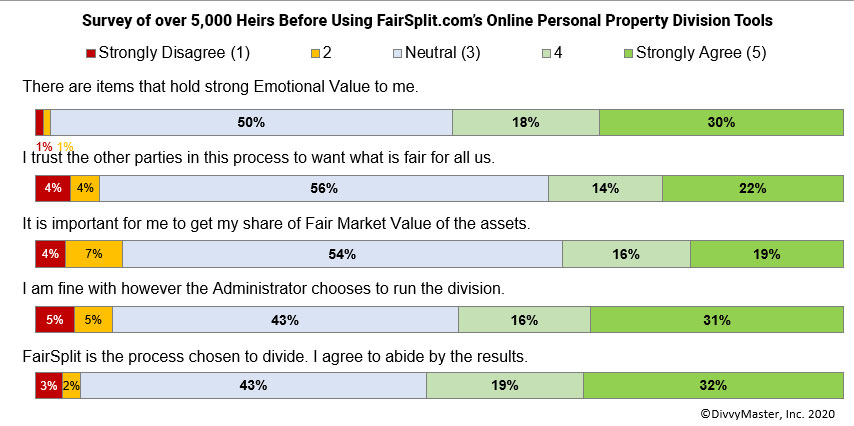

Over the years we have asked heirs in divisions to complete a short survey to help provide insights to the Administrator / Executor of an estate division and for our own understanding of the concerns and motivations of those dividing estates. For the first time we are sharing those results with the industry in the hopes of inspiring more thoughtful estate planning instructions and better cooperation between heirs. We do not believe there is now, or has ever been such insight into the frame of mind of heirs about to divide their family estates:

There is certainly a bias for any survey like this for some to take option 3, neutral to avoid revealing much about their true preferences. For the purpose of our conclusions, we are assuming that half of those choosing neutral (3) are at least slightly leaning toward strongly agree and half toward strongly disagree. You may look at the results and interpret somewhat differently.

Even taking that into account, the paucity of extremely agree or disagree means that some of the biases that would indicate clear and strong opinions on key areas are not so clear.

1/ Total trust in a sibling or trustee running a division process is rare. We have learned that most often, a family benefits from having an independent third party manage the division process to avoid the real or perceived advantage of being the one running it, and also participating in it.

2/ Another telling observation is that most indicate emotional value of things weighing on their decisions, or indicate neutrality. These emotionally charged items are where we have found the most likely areas of potential conflict. The often serve as focal points for the grief and sense of loss an heir may feel, so need to be treated carefully and fairly.

3/ Most indicate a desire to get their “share of the dollar value of things”. Many of our divisions are conducted without estimated values on items, since most household items are worth very little. An exception we have found is that when there are some items of considerably higher value than others, those items usually need to be valued and some kind of equalization used to provide balance percentages between heirs. That often means having appraisals or at least independent third party estimates on items above some threshold. For some families it is $500 or $1000, but sometimes it is anything above $50. The thing all seem to want to avoid, is one sibling of three for example, getting 6 out of 10 of high value items, making their percentage of the dollar value way above others.

The insights provided here are from the table, but also from countless phone conversations with heirs sharing their personal opinions on these topics, and the executors / trustees sharing the points of contention they are dealing with in their particular families. I hope you will find the information helpful in your own estate planning and for your plans on how to divide the unnamed items of an estate.